SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, For use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive proxy statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material pursuant to Section 240.14a-12 |

Titan Pharmaceuticals, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

TITAN PHARMACEUTICALS, INC.

400 Oyster Point Boulevard

Suite 505

South San Francisco, California 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held September 6, 2007

To the Stockholders of

Titan Pharmaceuticals, Inc.

Notice is hereby given that the Annual Meeting of the Stockholders of Titan Pharmaceuticals, Inc. (the “Company”) will be held on September 6, 2007 at 9:00 a.m. local time at the offices of the Company, 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080. The meeting is called for the following purpose:

1. To elect a board of nine directors;

2. To approve the appointment of Odenberg, Ullakko, Muranishi & Co. LLP as the independent auditors of the Company for the fiscal year ending December 31, 2007; and

3. To consider and take action upon such other matters as may properly come before the meeting or any adjournment or adjournments thereof.

The close of business on July 24, 2007 has been fixed as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting. The stock transfer books of the Company will not be closed. A list of the stockholders entitled to vote at the meeting may be examined at the Company’s offices during the 10-day period preceding the meeting.

All stockholders are cordially invited to attend the meeting. Whether or not you expect to attend, you are respectfully requested by the Board of Directors to sign, date and return the enclosed proxy promptly. Stockholders who execute proxies retain the right to revoke them at any time prior to the voting thereof. A return envelope which requires no postage if mailed in the United States is enclosed for your convenience.

| By Order of the Board of Directors, |

| Louis R. Bucalo, M.D. Chairman, President and Chief Executive Officer |

Dated: August 15, 2007

TITAN PHARMACEUTICALS, INC.

400 Oyster Point Boulevard

Suite 505

South San Francisco, California 94080

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Titan Pharmaceuticals, Inc. (the “Company,” “Titan,” “we,” “us,” or “our”) for the Annual Meeting of Stockholders to be held at the offices of the Company, 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080 on September 6, 2007, at 9:00 a.m. and for any adjournment or adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Any stockholder giving such a proxy has the power to revoke it at any time before it is voted. Written notice of such revocation should be forwarded directly to the Secretary of the Company, at the above stated address.

If the enclosed proxy is properly executed and returned, the shares represented thereby will be voted in accordance with the directions thereon and otherwise in accordance with the judgment of the persons designated as proxies. Any proxy on which no direction is specified will be voted in favor of the actions described in this Proxy Statement and for the election of the nominees set forth under the caption “Election of Directors.”

The approximate date on which this Proxy Statement and the accompanying form of proxy will first be mailed or given to the Company’s stockholders is August 22, 2007.

Your vote is important. Accordingly, you are urged to sign and return the accompanying proxy card whether or not you plan to attend the meeting. If you do attend, you may vote by ballot at the meeting and cancel any proxy previously given.

VOTING SECURITIES

Only holders of shares of common stock, $.001 par value per share (the “Shares”), of record at the close of business on July 24, 2007 are entitled to vote at the meeting. On the record date, the Company had outstanding and entitled to vote 44,474,986 Shares. For purposes of voting at the meeting, each Share is entitled to one vote upon all matters to be acted upon at the meeting. A majority in interest of the outstanding Shares represented at the meeting in person or by proxy shall constitute a quorum. The affirmative vote of a plurality of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required for the election of our directors. The affirmative vote of a majority of the votes present in person or represented by proxy at the Annual Meeting and entitled to vote is required to ratify the appointment of Odenberg, Ullakko, Muranishi & Co. LLP, independent certified public accountants, as our independent auditors. Any Shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on the election of directors, except to the extent that the failure to vote for any individual may result in another individual’s receiving a larger proportion of votes. Except for determining the presence or absence of a quorum for the transaction of business, broker non-votes are not counted for any purpose in determining whether a matter has been approved.

1

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the meeting, nine directors will be elected by the stockholders to serve until the next Annual Meeting of Stockholders or until their successors are elected and shall qualify. It is intended that the accompanying proxy will be voted for the election, as directors, of the nine persons named below, unless the proxy contains contrary instructions. The Company has no reason to believe that any of the nominees will not be a candidate or will be unable to serve. However, in the event that any of the nominees should become unable or unwilling to serve as a director, the persons named in the proxy have advised that they will vote for the election of such person or persons as shall be designated by the directors.

The following sets forth the names and ages of the nine nominees for election to the Board of Directors, their respective principal occupations or brief employment history and the period during which each has served as a director of the Company.

| Name |

Age | Director Since | ||

| Louis R. Bucalo, M.D. (1) |

48 | March 1993 | ||

| Victor J. Bauer, Ph.D. |

71 | November 1997 | ||

| Sunil Bhonsle |

57 | February 2004 | ||

| Eurelio M. Cavalier (1)(3)(4) |

74 | September 1998 | ||

| Hubert E. Huckel, M.D. (1)(2)(3) |

75 | October 1995 | ||

| Joachim Friedrich Kapp, M.D., Ph.D. |

64 | August 2005 | ||

| M. David MacFarlane, Ph.D. (2)(4) |

66 | May 2002 | ||

| Ley S. Smith (1)(2)(4) |

72 | July 2000 | ||

| Konrad M. Weis, Ph.D. (1)(3) |

78 | March 1993 |

| (1) | Member of Executive Committee |

| (2) | Member of Audit Committee |

| (3) | Member of Compensation Committee |

| (4) | Member of Nominating Committee |

Louis R. Bucalo, M.D. is the founder of Titan and has served as our President and Chief Executive Officer since January 1993. Dr. Bucalo has served as a director of Titan since March 1993 and was elected Chairman of the Board of Directors in January 2000. From July 1990 to April 1992, Dr. Bucalo was Associate Director of Clinical Research at Genentech, Inc., a biotechnology company. Dr. Bucalo holds an M.D. from Stanford University and a B.A. in biochemistry from Harvard University.

Victor J. Bauer, Ph.D. has served on our Board of Directors since November 1997. Dr. Bauer serves as the Executive Vice President of Concordia Pharmaceuticals, Inc., a biopharmaceutical company he co-founded in January 2004. From February 1997 through March 2003, Dr. Bauer was employed by Titan, most recently as our Executive Director of Corporate Development. From April 1996 until its merger into Titan, Dr. Bauer also served as a director and Chairman of Theracell. From December 1992 until February 1997, Dr. Bauer was a self-employed consultant to companies in the pharmaceutical and biotechnology industries. Prior to that time, Dr. Bauer was with Hoechst-Roussel Pharmaceuticals Inc., where he served as President from 1988 through 1992.

Sunil Bhonsle has served as our Executive Vice President and Chief Operating Officer since September 1995, and has served as a director of Titan since February 2004. Mr. Bhonsle served in various positions, including Vice President and General Manager—Plasma Supply and Manager—Inventory and Technical Planning, at Bayer Corporation from July 1975 until April 1995. Mr. Bhonsle holds an M.B.A. from the University of California at Berkeley and a B.Tech. in chemical engineering from the Indian Institute of Technology.

2

Eurelio M. Cavalier has served on our Board of Directors since September 1998. He was employed in various capacities by Eli Lilly & Co. from 1958 until his retirement in 1994, serving as Vice President Sales from 1976 to 1982 and Group Vice President U.S. Pharmaceutical Business Unit from 1982 to 1993. Mr. Cavalier currently serves on the Board of Directors of ProSolv, Inc.

Hubert E. Huckel, M.D. has served on our Board of Directors since October 1995. He served in various positions with The Hoechst Group from 1964 until his retirement in December 1992. At the time of his retirement, Dr. Huckel was Chairman of the Board of Hoechst-Roussel Pharmaceuticals, Inc., Chairman and President of Hoechst-Roussel Agri-Vet Company and a member of the Executive Committee of Hoechst Celanese Corporation. He currently serves on the Board of Directors of ThermoGenesis Corp., Valera Pharmaceuticals, Inc., Catalyst Pharmaceuticals, Inc. and Concordia Pharmaceuticals, Inc. He is a member of the compensation committee of ThermoGenesis Corp.

Joachim Friedrich Kapp, M.D., Ph.D. has served on our Board of Directors since August 2005. Dr. Kapp has worked in various capacities for Schering AG since 1975, from 1991 on as President of the Global Business Unit, Specialized Therapeutics. Dr. Kapp worked in various capacities with Warner Lambert and its subsidiaries between 1984 and 1990. Dr. Kapp holds an M.D. and a Ph.D. from The University of Essen, Germany.

M. David MacFarlane, Ph.D. has served on the Board of Directors since May 2002. From 1989 until his retirement in August 1999, Dr. MacFarlane served as Vice President and Responsible Head of Regulatory Affairs of Genentech, Inc. Prior to joining Genentech, Inc., he served in various positions with Glaxo Inc., last as Vice President of Regulatory Affairs.

Ley S. Smith has served on our Board of Directors since July 2000. He served in various positions with The Upjohn Company and Pharmacia & Upjohn from 1958 until his retirement in November 1997. From 1991 to 1993 he served as Vice Chairman of the Board of The Upjohn Company, and from 1993 to 1995 he was President and Chief Operating Officer of The Upjohn Company. At the time of his retirement, Mr. Smith was Executive Vice President of Pharmacia & Upjohn, and President of Pharmacia & Upjohn’s U.S. Pharma Product Center.

Konrad M. Weis, Ph.D. has served on our Board of Directors since March 1993. He is the former President, Chief Executive Officer and Honorary Chairman of Bayer Corporation. Since 1995, Dr. Weis has been serving as a director and member of the Investment Committee of The Heinz Endowment in Pittsburgh. Since 2004, he has been serving as Emeritus Life Trustee of Carnegie-Mellon University and its Executive Committee, and of the Carnegie Museums of Pittsburgh.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE ABOVE NOMINEES.

3

EXECUTIVE OFFICERS

The following sets forth the names and ages of our executive officers, their respective positions and offices, and their respective principal occupations or brief employment history.

| Name |

Age | Office | ||

| Louis R. Bucalo, M.D. |

48 | Chairman, President and Chief Executive Officer | ||

| Sunil Bhonsle |

57 | Executive Vice President, Chief Operating Officer and Director | ||

| Robert E. Farrell, J.D. |

57 | Executive Vice President and Chief Financial Officer |

Louis R. Bucalo, M.D. see biographical information set forth above under “Election of Directors.”

Sunil Bhonsle see biographical information set forth above under “Election of Directors.”

Robert E. Farrell has served as our Executive Vice President and Chief Financial Officer since September 1996. Mr. Farrell was employed by Fresenius USA, Inc. from 1991 until August 1996 where he served in various capacities, including Vice President Administration, Chief Financial Officer and General Counsel. His last position was Corporate Group Vice President. Mr. Farrell holds a B.A. from the University of Notre Dame and a J.D. from Hastings College of Law, University of California.

The Board and Board Committees

Board Committees

Board of Directors. The Board of Directors met five times during 2006. Each director is expected to attend meetings of our Board of Directors and meetings of committees of our Board of Directors of which he is a member, and to spend the time necessary to properly discharge his respective duties and responsibilities. During 2006, each incumbent director attended at least 75% of the total number of meetings of our Board of Directors and meetings of committees of our Board of Directors of which he was a member. We do not have a policy with regard to Board members’ attendance at annual meetings of stockholders. Dr. Bucalo and Mr. Bhonsle attended the Company’s previous annual meeting.

The following members of our Board of Directors meet the independence requirements and standards currently established by the American Stock Exchange: Victor J. Bauer, Eurelio M. Cavalier, Hubert E. Huckel, Joachim Friedrich Kapp, M. David MacFarlane, Ley S. Smith and Konrad M. Weis.

The Board of Directors has an Executive Committee, a Compensation Committee, a Nominating Committee and an Audit Committee.

Executive Committee. The Executive Committee exercises all the power and authority of the Board of Directors in the management of Titan between Board meetings, to the extent permitted by law. The Executive Committee did not meet during 2006.

Compensation Committee. The Compensation Committee makes recommendations to the Board of Directors concerning salaries and incentive compensation for our officers, including our Chief Executive Officer, and employees and administers our stock option plans. The Compensation Committee consists of three directors, Eurelio M. Cavalier, Hubert E. Huckel and Konrad M. Weis, each of whom meets the independence requirements and standards currently established by the American Stock Exchange. During 2006, the Compensation Committee met one time and took action by unanimous consent three times. The Compensation Committee operates under a written charter, a copy of which is attached to this proxy statement.

Nominating Committee. The purpose of the Nominating Committee is to assist the Board of Directors in identifying qualified individuals to become board members, in determining the composition of the Board of

4

Directors and in monitoring the process to assess Board effectiveness. The Nominating Committee consists of three directors, Eurelio M. Cavalier, M. David MacFarlane and Ley S. Smith, each of whom meets the independence requirements and standards currently established by the American Stock Exchange. The Nominating Committee did not meet during 2006 but took action by unanimous consent one time. The Nominating Committee operates under a written charter, a copy of which is attached to this proxy statement. Although it has not done so in the past, the Nominating Committee may retain search firms to assist in identifying suitable director candidates.

The Nominating Committee will consider director candidates recommended by security holders. Potential nominees to the Board of Directors are required to have such experience in business or financial matters as would make such nominee an asset to the Board of Directors and may, under certain circumstances, be required to be “independent”, as such term is defined in the American Stock Exchange Rules and applicable Securities and Exchange Commission (“SEC”) regulations. Security holders wishing to submit the name of a person as a potential nominee to the Board of Directors must send the name, address, and a brief (no more than 500 words) biographical description of such potential nominee to the Nominating Committee at the following address: Nominating Committee of the Board of Directors, c/o Titan Pharmaceuticals, Inc., 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080. Potential director nominees will be evaluated by personal interview, such interview to be conducted by one or more members of the Nominating Committee, and/or any other method the Nominating Committee deems appropriate, which may, but need not include a questionnaire. The Nominating Committee may solicit or receive information concerning potential nominees from any source it deems appropriate. The Nominating Committee need not engage in an evaluation process unless (i) there is a vacancy on the Board of Directors, (ii) a director is not standing for re-election, or (iii) the Nominating Committee does not intend to recommend the nomination of a sitting director for re-election. A potential director nominee recommended by a security holder will not be evaluated any differently than any other potential nominee.

Audit Committee. The Audit Committee (which is formed in compliance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended , or the “Exchange Act”) consists of three directors, Ley S. Smith, M. David MacFarlane and Hubert E. Huckel, each of whom meets the independence requirements and standards currently established by the American Stock Exchange and the SEC. In addition, the Board of Directors has determined that Mr. Smith is an “audit committee financial expert” and “independent” as defined under the relevant rules of the SEC and the American Stock Exchange. The Audit Committee assists the Board by overseeing the performance of the independent auditors and the quality and integrity of Titan’s internal accounting, auditing and financial reporting practices. The Audit Committee is responsible for retaining (subject to stockholder ratification) and, as necessary, terminating, the independent auditors, annually reviews the qualifications, performance and independence of the independent auditors and the audit plan, fees and audit results, and pre-approves audit and non-audit services to be performed by the auditors and related fees. The Audit Committee operates under a written charter, a copy of which is attached to this proxy statement. During 2006, the Audit Committee met four times.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to our directors, officers and employees, including our Chief Executive Officer and Chief Financial Officer (our principal executive officer and principal financial and accounting officer, respectively). The Code was filed as Exhibit 14 to our annual report on Form 10-K for the year ended December 31, 2003 and has been incorporated by reference into this annual report. A written copy of the Code will be provided upon request at no charge by writing to our Chief Financial Officer, Titan Pharmaceuticals, Inc., 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080.

5

Formation of Audit Committee and Financial Expert

The Audit Committee (which is formed in compliance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934) consists of Ley S. Smith, M. David MacFarlane and Hubert E. Huckel, each of whom meets the independence requirements and standards currently established by the American Stock Exchange and the SEC. In addition, the Board of Directors has determined that Mr. Ley S. Smith is an “audit committee financial expert” and “independent” as defined under the relevant rules of the SEC and the American Stock Exchange.

Changes in Director Nomination Process for Stockholders

None.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who beneficially own more than 10% of a registered class of our equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Such executive officers, directors, and greater than 10% beneficial owners are required by SEC regulation to furnish us with copies of all Section 16(a) forms filed by such reporting persons.

Based solely on our review of such forms furnished to us and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were complied with during 2006.

6

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This compensation discussion describes the material elements of compensation awarded to, earned by, or paid to each of our executive officers who served as named executive officers during the last completed fiscal year. This compensation discussion focuses on the information contained in the following tables and related footnotes and narrative for primarily the last completed fiscal year, but we also describe compensation actions taken before or after the last completed fiscal year to the extent it enhances the understanding of our executive compensation disclosure.

Our Compensation Committee currently oversees the design and administration of our executive compensation program.

The principal elements of our executive compensation program are base salary, annual cash incentives, long-term equity incentives in the form of stock options, other benefits and perquisites, post-termination severance and acceleration of stock option vesting for certain named executive officers upon termination and/or a change in control. Our other benefits and perquisites consist of life, health and disability insurance benefits, and a qualified 401(k) savings plan. Our philosophy is to position the aggregate of these elements at a level that is competitive within the industry and commensurate with our size and performance.

Compensation Program Objectives and Philosophy

In General. The objectives of our compensation programs are to:

| • | attract, motivate and retain talented and dedicated executive officers, |

| • | provide our executive officers with both cash and equity incentives to further our interests and those of our stockholders, and |

| • | provide employees with long-term incentives so we can retain them and provide stability during our growth stage. |

Generally, the compensation of our executive officers is composed of a base salary, an annual incentive compensation award and equity awards in the form of stock options based on individual and company performance. In adjusting base salaries, the Compensation Committee reviews the individual contributions of the particular executive. The annual incentive compensation award is a discretionary award determined by the Compensation Committee based on company performance. In addition, stock options are granted to provide the opportunity for long-term compensation based upon the performance of our common stock over time.

Competitive Market. We define our competitive markets for executive talent to be the pharmaceutical and biotechnology industries in northern California and New Jersey. To date, we have utilized the Radford Biotechnology Surveys, a third party market specific compensation survey, to benchmark our executive compensation.

Compensation Process. The Compensation Committee reviews and approves all elements of compensation for each of our named executive officers taking into consideration recommendations from our principal executive officer (for compensation other than his own), as well as competitive market guidance from the Radford Biotechnology Surveys.

Base Salaries

In General. We provide the opportunity for our named executive officers and other executives to earn a competitive annual base salary to attract and retain an appropriate caliber of talent for the applicable position, and

7

to provide a base wage that is not subject to our performance risk. We review base salaries for our named executive officers annually and cost of living increases and other changes are based on compensation surveys, the Company’s performance and individual performance, such as meeting product development and corporate objectives. The salary of our principal executive officer and the salaries of our named executive officers are set by the Compensation Committee.

Total Compensation Comparison. Base salaries accounted for approximately 73% of total compensation for the principal executive officer and approximately 81% on average for our other named executive officers.

Annual Cash Incentives

In General. We provide the opportunity for our named executive officers and other executives to earn an annual cash incentive award. We provide this opportunity to attract and retain an appropriate caliber of talent for the position and to motivate executives to achieve our annual business goals. We review potential annual cash incentive awards for our named executive officers and other executives annually to determine award payments, if any, for the last completed fiscal year, as well as to establish award opportunities for the current fiscal year. We do not have a formal annual incentive plan and payment of annual cash incentive awards are subject to the discretion of the Compensation Committee.

Target Award Opportunities. Our 2006 cash incentive awards were subject to the Compensation Committee’s discretion and took into account corporate performance measures, including, but not limited to, product development milestones and results of operations. There are annual target award opportunities expressed as a percentage of base salary paid during the fiscal year as specified in the employment agreements. For the last completed fiscal year, annual cash incentive opportunities for the named executive officers are summarized below. There were no cash bonuses paid to our named executive officers during or related to 2006.

| Annual Incentive Award Opportunity Target Performance |

Amount Paid | ||||||||||

| % Salary | Amount | ||||||||||

| Louis R. Bucalo, M.D. |

FY 2006 | 25 | % | $ | 94,490 | $ | — | ||||

| Sunil Bhonsle |

FY 2006 | 20 | % | 57,582 | — | ||||||

| Robert E. Farrell |

FY 2006 | 20 | % | 48,067 | — | ||||||

| Richard C. Allen, Ph.D. (1) |

FY 2006 | 20 | % | — | — | ||||||

| (1) | Dr. Allen’s employment terminated in March 2006. |

Individual Performance Goals. The performance goals for the executives are aligned with the objectives for the Company and seek to advance our product development goals. The Compensation Committee takes into account individual and Company performance in determining awards.

Discretionary Adjustments. Incentive awards are subject to the Compensation Committee’s discretion. We may make adjustments to our overall corporate performance goals and our actual performance results that may cause differences between the numbers used for our performance goals and the numbers reported in our financial statements. These adjustments may exclude all or a portion of both the positive or negative effect of external events that are outside the control of our executives, such as natural disasters, litigation, or regulatory changes in accounting or taxation standards. These adjustments may also exclude all or a portion of both the positive or negative effect of unusual or significant strategic events that are within the control of our executives but that are undertaken with an expectation of improving our long-term financial performance, such as restructurings, acquisitions, or divestitures.

Total Compensation Comparison. For the last completed fiscal year, cash incentive awards accounted for none of the total compensation for the principal executive officer and our other named executive officers.

8

Long-term Equity Incentives

We provide the opportunity for our named executive officers and other executives to earn a long-term equity incentive award. Long-term incentive awards provide employees with the incentive to stay with us for longer periods of time, which in turn, provides us with greater stability. Equity awards also are less costly to us in the short term than cash compensation. We review long-term equity incentives for our named executive officers and other executives annually.

For our named executive officers, our stock option grants are of a size and term determined and approved by the Compensation Committee in consideration of the range of grants in the Radford Survey. We have traditionally used stock options as our form of equity compensation because stock options provide a relatively straightforward incentive for our executives, result in less immediate dilution of existing shareholders’ interests and, prior to our adoption of FAS 123(R), resulted in less compensation expense for us relative to other types of equity awards. Generally, all grants of stock options to our employees were granted with exercise prices equal to or greater than the fair market value of our common stock on the respective grant dates. For a discussion of the determination of the fair market value of these grants, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and the Use of Estimates” included in our Annual Report on Form 10-K for the year ended December 31, 2006.

We do not time stock option grants to executives in coordination with the release of material non-public information. For the last two years, annual grants to employees (including executive officers) have been made on the first business day of the year. Beginning with annual grants for 2007, the grants will be made on the first Monday in January that is a business day. Initial Director option grants may be granted on the date the Director joins the Board of Directors. Biennial Director option grants are granted automatically upon election at the annual shareholder meeting. Director committee option grants are made at the first meeting of the Board of Directors after Titan’s annual shareholder meeting. We also make automatic option grants on the five and ten year anniversary date of an employee’s employment. Newly-hired employees may be granted options on the first day of employment. Our stock option grants have a 10-year contractual exercise term. In general, the option grants are also subject to the following post-termination and change in control provisions:

| Event |

Award Vesting |

Exercise Term | ||

| • Termination by us for Reason Other than Cause, Disability or Death |

• Forfeit Unvested Options |

• Earlier of: (1) 90 days or (2) Remaining Option Period | ||

| • Termination for Disability, Death or Retirement |

• Forfeit Unvested Options |

• Earlier of: (1) 2 years or (2) Remaining Option Period | ||

| • Termination for Cause |

• Forfeit Vested and Unvested Options |

• Expire | ||

| • Other Termination |

• Forfeit Unvested Options |

• Earlier of: (1) 90 days or (2) Remaining Option Period | ||

| • Change in Control |

• Accelerated* |

• * | ||

| * | The Compensation Committee may provide that, in the event of a change in control, any outstanding awards that are unexercisable or otherwise unvested will become fully vested and immediately exercisable. If there is a termination of employment, the applicable termination provisions regarding exercise term will apply. |

The vesting of certain of our named executive officers’ stock options is accelerated pursuant to the terms of their employment agreements in certain termination and/or change in control events. These terms are more fully described in “Executive Compensation—Employment Agreements” and “Executive Compensation—Potential Payments Upon Termination or Change in Control.”

Total Compensation Comparison. Long-term equity incentives accounted for approximately 27% of total compensation for the principal executive officer and approximately 19% on average for our other named executive officers.

9

Executive Benefits and Perquisites

In General. We generally provide for our named executive officers and other executives to receive the same general health and welfare benefits offered to all employees. We currently provide no other perquisites to our named executive officers and other executives. We also offer participation in our defined contribution 401(k) plan. We do not match employee contributions under our 401(k) plan.

Total Compensation Comparison. Personal benefits and perquisites accounted for approximately 1% of total compensation for the principal executive officer and our other named executives officers.

Change in Control and Severance Benefits

In General. We provide the opportunity for certain of our named executive officers to be protected under the severance and change in control provisions contained in their employment agreements. We provide this opportunity to attract and retain an appropriate caliber of talent for the applicable position. Our severance and change in control provisions for the named executive officers are summarized in “Executive Compensation—Employment Agreements” and “Executive Compensation—Potential Payments Upon Termination or Change in Control.” Our analysis indicates that our severance and change in control provisions are consistent with the provisions and benefit levels of other companies disclosing such provisions as reported in public SEC filings. We believe our arrangements are reasonable in light of the fact that cash severance is limited to the greater of the term of the agreement or two years for the Principal Executive Officer (at a rate equal to his then current base salary) and nine months for other named executive officers (at a rate equal to their then current base salary), there is no severance increase with a change in control and there are no “single trigger” benefits upon a change in control.

Compensation Committee Interlocks and Insider Participation

Members of our Compensation Committee of the Board of Directors were Mr. Eurelio M. Cavalier, Dr. Hubert E. Huckel and Dr. Konrad M. Weis. No member of our Compensation Committee was, or has been, an officer or employee of Titan or any of our subsidiaries.

No member of the Compensation Committee has a relationship that would constitute an interlocking relationship with executive officers or directors of the Company or another entity.

Compensation Committee Report (1)

The goal of the Company’s executive compensation policy is to ensure that an appropriate relationship exists between executive compensation and the creation of stockholder value, while at the same time attracting, motivating and retaining experienced executive officers.

The Compensation Committee has reviewed and discussed the discussion and analysis of Titan’s compensation which appears above with management, and, based on such review and discussion, the Compensation Committee recommended to Titan’s Board of Directors that the above disclosure be included in the Annual Report on Form 10-K for the year ended December 31, 2006 and in this proxy statement.

The members of the Compensation Committee are:

Eurelio M. Cavalier, Chair

Hubert E. Huckel, M.D.

Konrad M. Weis, Ph.D.

| (1) | The material in the above Audit Committee reports is not soliciting material, is not deemed filed with the SEC and is not incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filing. |

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows information concerning the annual compensation for services provided to us by our Chief Executive Officer, the Chief Financial Officer and our three other most highly compensated executive officers during 2006.

| Name and Principal Position |

Year | Salary ($) |

Bonus (1) ($) |

Option Awards (2) ($) |

All Other Compensation (3) ($) |

Total Compensation ($) | |||||||||||

| Louis R. Bucalo, M.D. |

2006 | $ | 378,471 | $ | — | $ | 137,919 | $ | — | $ | 516,390 | ||||||

| President and Chief Executive Officer |

|||||||||||||||||

| Sunil Bhonsle |

2006 | 288,421 | — | 87,763 | — | 376,184 | |||||||||||

| Executive Vice President and Chief Operating Officer |

|||||||||||||||||

| Robert E. Farrell |

2006 | 240,846 | — | 55,484 | — | 296,330 | |||||||||||

| Executive Vice President and Chief Financial Officer |

|||||||||||||||||

| Richard C. Allen, Ph.D. (4) |

2006 | 246,009 | — | 36,102 | — | 282,111 | |||||||||||

| Executive Vice President, Cell Therapy |

|||||||||||||||||

| (1) | No bonuses were paid to our named executive officers during or related to 2006 |

| (2) | Valuation based on the dollar amount of option grants recognized for financial statement reporting purposes pursuant to FAS 123(R) with respect to 2006. The assumptions used by us with respect to the valuation of option grants are set forth in our Annual Report on Form 10-K for the year ended December 31, 2006 under “Titan Pharmaceuticals, Inc. Consolidated Financial Statements—Notes to Financial Statements—Note 1—Organization and Summary of Significant Accounting Policies—Stock Option Plans.” The individual awards reflected in the summary compensation table are summarized below: |

| Grant Date | Number of Shares |

Amount Recognized in Financial Statements in 2006 | |||||

| Louis R. Bucalo, M.D. |

1/3/2006 | 195,000 | $ | 82,543 | |||

| 8/29/2006 | 20,000 | 2,695 | |||||

| 9/5/2006 | 5,000 | 2,556 | |||||

| Sunil Bhonsle |

1/3/2006 | 135,000 | 56,006 | ||||

| 8/29/2006 | 20,000 | 2,695 | |||||

| Robert E. Farrell |

1/3/2006 | 67,500 | 28,239 | ||||

| 9/21/2006 | 45,000 | 8,562 | |||||

| Richard C. Allen, Ph.D. |

1/3/2006 | 57,000 | 23,647 | ||||

| (3) | No other compensation, including perquisites, in excess of $10,000 was paid to any of our named executive officers during 2006. |

| (4) | Dr. Allen’s employment was terminated in March 2006. He received salary continuation payments until December 2006. Dr. Allen’s outstanding options will continue to vest under the terms of his consulting agreement through February 2008. |

For a description of the material terms of employment agreements with our named executive officers, see “Executive Compensation—Employment Agreements.”

11

Grants of Plan-Based Awards in Fiscal 2006

The following table summarizes our awards made to our named executive officers under any plan in 2006.

| Name |

Grant Date | Approval Date (2) |

Number of Shares of Common Stock Underlying Options (#) |

Exercise or Base Price of Option Awards ($/Sh) |

Grant Date Fair Value of Stock and Option Awards ($)(3) |

Grant Date Fair Market Value of a Share ($/Sh) | ||||||||||

| Louis R. Bucalo, M.D. |

1/3/2006 | 12/29/2005 | 195,000 | (4) | $ | 1.40 | $ | 163,137 | $ | 0.84 | ||||||

| 8/29/2006 | 8/29/2006 | 20,000 | (5) | 2.35 | 31,752 | 1.59 | ||||||||||

| 9/5/2006 | 9/5/2006 | 5,000 | (6) | 2.48 | 7,975 | 1.60 | ||||||||||

| Sunil Bhonsle |

1/3/2006 | 12/29/2005 | 135,000 | (4) | 1.40 | 112,941 | 0.84 | |||||||||

| 8/29/2006 | 8/29/2006 | 20,000 | (5) | 2.48 | 31,752 | 1.59 | ||||||||||

| Robert E. Farrell |

1/3/2006 | 12/29/2005 | 67,500 | (4) | 1.40 | 56,471 | 0.84 | |||||||||

| 9/21/2006 | 9/21/2006 | 45,000 | (4) | 2.09 | 61,547 | 1.37 | ||||||||||

| Richard C. Allen, Ph.D. (7) |

1/3/2006 | 12/29/2005 | 57,000 | (4) | 1.40 | 47,686 | 0.84 | |||||||||

| (1) | Each award was granted under the Titan Pharmaceuticals, Inc. 2002 Stock Option Plan. |

| (2) | All grants were approved by the Compensation Committee on the dates indicated to be granted on the indicated grant date. |

| (3) | Valuation assumptions are found in our Annual Report on Form 10-K for the year ended December 31, 2006 under “Titan Pharmaceuticals, Inc. Consolidated Financial Statements—Notes to Financial Statements—Note 1—Organization and Summary of Significant Accounting Policies—Stock Option Plans.” |

| (4) | These options vest over a two year period with fifty percent vesting on the first anniversary and the remaining fifty percent vesting in twelve equal monthly installments. |

| (5) | These options vest in forty-eight equal monthly installments beginning on August 29, 2006. |

| (6) | These options vest in twelve equal monthly installments beginning on September 5, 2006. |

| (7) | Dr. Allen’s employment was terminated in March 2006. Dr. Allen’s outstanding options will continue to vest under the terms of his consulting agreement through February 2008. |

Employee Benefits Plans

Stock Option Plans

The principal purpose of the Stock Option Plans is to attract, motivate, reward and retain selected employees, consultants and directors through the granting of stock-based compensation awards. The Stock Option Plans provides for a variety of awards, including non-qualified stock options, incentive stock options (within the meaning of Section 422 of the Code), stock appreciation rights, restricted stock awards, performance-based awards and other stock-based awards.

2002 Stock Option Plan

In July 2002, we adopted the 2002 Stock Option Plan (2002 Plan). The 2002 Plan assumed the options which remain available for grant under our option plans previously approved by stockholders. Under the 2002 Plan and predecessor plans, a total of approximately 6.4 million shares of our common stock were authorized for issuance to employees, officers, directors, consultants, and advisers. Options granted under the 2002 Plan and predecessor plans may either be incentive stock options within the meaning of Section 422 of the Internal Revenue Code and/or options that do not qualify as incentive stock options; however, only employees are eligible to receive incentive stock options. Options granted under the option plans generally expire no later than ten years from the date of grant, except when the grantee is a 10% shareholder, in which case the maximum term is five years from the date of grant. Options generally vest at the rate of one fourth after one year from the date of grant and the remainder ratably over the subsequent three years, although options with different vesting terms are

12

granted from time-to-time. Generally, the exercise price of any options granted under the 2002 Plan must be at least 100% of the fair market value of our common stock on the date of grant, except when the grantee is a 10% shareholder, in which case the exercise price shall be at least 110% of the fair market value of our common stock on the date of grant.

In August 2005, we adopted an amendment to the 2002 Stock Option Plan (2002 Plan) to (i) permit the issuance of Shares of restricted stock and stock appreciation rights to participants under the 2002 Plan, and (ii) increase the number of Shares issuable pursuant to grants under the 2002 Plan from 2,000,000 to 3,000,000.

2001 Stock Option Plan

In August 2001, we adopted the 2001 Employee Non-Qualified Stock Option Plan (2001 NQ Plan) pursuant to which 1,750,000 shares of common stock were authorized for issuance for option grants to employees and consultants who are not officers or directors of Titan. Options granted under the option plans generally expire no later than ten years from the date of grant. Option vesting schedule and exercise price are determined at time of grant by the Board of Directors. Generally, the exercise prices of options granted under the 2001 NQ Plan were 100% of the fair market value of our common stock on the date of grant.

Administration. The Stock Option Plans are administered by our Compensation Committee. The Compensation Committee may in certain circumstances delegate certain of its duties to one or more of our officers. The Compensation Committee has the power to interpret the Stock Option Plans and to adopt rules for the administration, interpretation and application of the plans according to their terms.

Grant of Awards; Shares Available for Awards. Certain employees, consultants and directors are eligible to be granted awards under the plans. The Compensation Committee will determine who will receive awards under the plans, as well as the form of the awards, the number of shares underlying the awards, and the terms and conditions of the awards consistent with the terms of the plans.

A total of approximately 8.3 million shares of our common stock are available for issuance or delivery under our existing Stock Option Plans. The number of shares of our common stock issued or reserved pursuant to the Stock Option Plans will be adjusted at the discretion of our Board or the Compensation Committee as a result of stock splits, stock dividends and similar changes in our common stock. In addition, shares subject to grant under our prior option plans (including shares under such plans that expire unexercised or are forfeited, terminated, canceled or withheld for income tax withholding) shall be merged and available for issuance under the 2002 Stock Option Plan, without reducing the aggregate number of shares available for issuance reflected above.

Stock Options. The Stock Option Plans permit the Compensation Committee to grant participants incentive stock options, which qualify for special tax treatment in the United States, as well as non-qualified stock options. The Compensation Committee will establish the duration of each option at the time it is granted, with a maximum ten-year duration for incentive stock options, and may also establish vesting and performance requirements that must be met prior to the exercise of options. Stock option grants (other than incentive stock option grants) also may have exercise prices that are less than, equal to or greater than the fair market value of our common stock on the date of grant. Incentive stock options must have an exercise price that is at least equal to the fair market value of our common stock on the date of grant. Stock option grants may include provisions that permit the option holder to exercise all or part of the holder’s vested options, or to satisfy withholding tax liabilities, by tendering shares of our common stock already owned by the option holder for at least six months (or another period consistent with the applicable accounting rules) with a fair market value equal to the exercise price.

Stock Appreciation Rights. The Compensation Committee may also grant stock appreciation rights, which will be exercisable upon the occurrence of certain contingent events. Stock appreciation rights entitle the holder upon exercise to receive an amount in any combination of cash, shares of our common stock (as determined by the Compensation Committee) equal in value to the excess of the fair market value of the shares covered by the stock appreciation right over the exercise price of the right, or other securities or property owned by us.

13

Other Equity-Based Awards. In addition to stock options and stock appreciation rights, the Compensation Committee may also grant certain employees, consultants and directors shares of restricted stock, with terms and conditions as the Compensation Committee may, pursuant to the terms of the Stock Option Plan, establish. The Stock Option Plan does not allow awards to be made under terms and conditions which would cause such awards to be treated as deferred compensation subject to the rules of Section 409A of the Code.

Change-in-Control Provisions. In connection with the grant of an award, the Compensation Committee may provide that, in the event of a change in control, any outstanding awards that are unexercisable or otherwise unvested will become fully vested and immediately exercisable.

Amendment and Termination. The Compensation Committee may adopt, amend and rescind rules relating to the administration of the Stock Option Plans, and amend, suspend or terminate the Stock Option Plans, but no amendment will be made that adversely affects in a material manner any rights of the holder of any award without the holder’s consent, other than amendments that are necessary to permit the granting of awards in compliance with applicable laws. We have attempted to structure the Stock Option Plans so that remuneration attributable to stock options and other awards will not be subject to a deduction limitation contained in Section 162(m) of the Code.

Outstanding Equity Awards at Fiscal 2006

The following table summarizes the number of securities underlying outstanding plan awards for each named executive officer as of December 31, 2006.

| Option Awards | ||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date | ||||||

| Louis R. Bucalo, M.D. |

2,000 | — | $ | 2.88 | 7/30/2007 | |||||

| 59,200 | — | 5.30 | 6/10/2008 | |||||||

| 433,088 | — | 7.50 | 6/19/2008 | |||||||

| 5,000 | — | 4.14 | 7/24/2008 | |||||||

| 71,500 | — | 3.63 | 1/4/2009 | |||||||

| 28,000 | — | 3.69 | 2/4/2009 | |||||||

| 27,531 | — | 0.08 | 3/10/2009 | |||||||

| 5,000 | — | 9.06 | 8/30/2009 | |||||||

| 400,000 | — | 12.69 | 11/23/2009 | |||||||

| 20,000 | — | 43.63 | 8/28/2010 | |||||||

| 72,000 | — | 22.98 | 1/8/2011 | |||||||

| 69,000 | — | 11.63 | 8/9/2011 | |||||||

| 5,000 | — | 11.50 | 8/10/2011 | |||||||

| 150,000 | — | 8.77 | 1/16/2012 | |||||||

| 20,000 | — | 1.71 | 8/16/2012 | |||||||

| 80,000 | — | 1.50 | 3/1/2013 | |||||||

| 5,000 | — | 3.29 | 10/31/2013 | |||||||

| 75,000 | — | 3.69 | 2/9/2014 | |||||||

| 13,437 | 6,563 | (1) | 2.37 | 9/1/2014 | ||||||

| 50,000 | 50,000 | (2) | 2.62 | 2/7/2015 | ||||||

| 5,000 | — | 2.05 | 8/9/2015 | |||||||

| — | 195,000 | (3) | 1.40 | 1/3/2016 | ||||||

| 1,666 | 18,334 | (4) | 2.35 | 8/29/2016 | ||||||

| 1,250 | 3,750 | (5) | 2.48 | 9/5/2016 | ||||||

14

| Option Awards | |||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date | |||||

| Sunil Bhonsle |

41,600 | — | 5.30 | 6/10/2008 | |||||

| 165,158 | — | 7.50 | 6/19/2008 | ||||||

| 55,600 | — | 3.63 | 1/4/2009 | ||||||

| 21,000 | — | 3.69 | 2/4/2009 | ||||||

| 184,000 | — | 12.69 | 11/23/2009 | ||||||

| 42,000 | — | 22.98 | 1/8/2011 | ||||||

| 31,500 | — | 11.63 | 8/9/2011 | ||||||

| 90,000 | — | 8.77 | 1/16/2012 | ||||||

| 50,000 | — | 1.50 | 3/1/2013 | ||||||

| 60,000 | — | 3.69 | 2/9/2014 | ||||||

| 35,000 | 35,000 | (2) | 2.62 | 2/7/2015 | |||||

| — | 135,000 | (3) | 1.40 | 1/3/2016 | |||||

| 1,666 | 18,334 | (4) | 2.35 | 8/29/2016 | |||||

| Robert E. Farrell |

66,000 | — | 12.68 | 11/23/2009 | |||||

| 30,000 | — | 22.98 | 1/8/2011 | ||||||

| 22,500 | — | 11.63 | 8/9/2011 | ||||||

| 60,258 | — | 3.77 | 6/4/2012 | ||||||

| 68,294 | — | 1.71 | 8/16/2012 | ||||||

| 35,000 | — | 1.50 | 3/1/2013 | ||||||

| 35,000 | — | 3.69 | 2/9/2014 | ||||||

| 22,500 | 22,500 | (2) | 2.62 | 2/7/2015 | |||||

| — | 67,500 | (3) | 1.40 | 1/3/2016 | |||||

| — | 45,000 | (3) | 2.09 | 9/21/2016 | |||||

| Richard C. Allen, Ph.D.(6) |

33,300 | — | 5.30 | 6/10/2008 | |||||

| 61,961 | — | 7.50 | 6/19/2008 | ||||||

| 41,200 | — | 3.63 | 1/4/2009 | ||||||

| 21,000 | — | 3.69 | 2/4/2009 | ||||||

| 132,000 | — | 12.69 | 11/23/2009 | ||||||

| 36,000 | — | 22.98 | 1/8/2011 | ||||||

| 27,000 | — | 11.63 | 8/9/2011 | ||||||

| 85,000 | — | 8.77 | 1/16/2012 | ||||||

| 35,000 | — | 1.50 | 3/1/2013 | ||||||

| 30,000 | — | 3.69 | 2/9/2014 | ||||||

| 15,000 | 15,000 | (2) | 2.62 | 2/7/2015 | |||||

| — | 57,000 | (3) | 1.40 | 1/3/2016 | |||||

| (1) | These options vest in twelve equal monthly installments beginning on September 1, 2004. |

| (2) | These options vest in two equal annual installments beginning on February 7, 2005 |

| (3) | These options vest over a two year period with fifty percent vesting on the first anniversary and the remaining fifty percent vesting in twelve equal monthly installments. |

| (4) | These options vest in forty-eight equal monthly installments beginning on August 29, 2006. |

| (5) | These options vest in twelve equal monthly installments beginning on September 5, 2006. |

| (6) | Dr. Allen’s employment was terminated in March 2006. Dr. Allen’s outstanding options will continue to vest under the terms of his consulting agreement through February 2008. |

There were no option exercises by our named executive officers in 2006. To date, we have not granted any stock awards to our named executive officers.

15

Pension Benefits

We do not sponsor any qualified or non-qualified defined benefit plans.

Nonqualified Deferred Compensation

We do not maintain any non-qualified defined contribution or deferred compensation plans. The Compensation Committee, which is comprised solely of “outside directors” as defined for purposes of Section 162(m) of the Code, may elect to provide our officers and other employees with non-qualified defined contribution or deferred compensation benefits if the Compensation Committee determines that doing so is in our best interests. We sponsor a tax qualified defined contribution 401(k) plan in which Dr. Bucalo, Mr. Bhonsle, and Mr. Farrell participate.

Employment Agreements

Employment Agreement with Louis R. Bucalo

We are a party to an employment agreement with Dr. Bucalo which, as amended in February, 2007, expires in February 2010 and provides for a base annual salary, subject to annual increases of 5% and bonuses of up to 25% at the discretion of the Board of Directors.

Dr. Bucalo’s employment agreement may be terminated, with or without just cause, by our Board. If we terminate the employment agreement for just cause (as defined in the agreement) or on account of death or disability or if Dr. Bucalo terminates the agreement for any reason other than just cause (as defined in the agreement), Dr. Bucalo is entitled to no further compensation or benefits other than those earned through the date of termination. If we terminate the agreement for any reason other than for just cause, death or disability, we provide severance of continued payment of cash compensation at a rate of his then current base annual salary for a period equal to the greater of the balance of the term of the agreement or two years, subject to offset for earnings after the first 18 months following termination.

Employment Agreements with Other Executive Officers

In addition to the employment agreement with Dr. Bucalo, we have entered into employment agreements with Sunil Bhonsle and Robert E. Farrell. The employment agreements generally provide for a base salary and eligibility to receive an annual performance bonus up to a specified percentage of base salary. The actual amount of the annual bonus is discretionary and determined based upon the executive’s performance, our performance and certain performance targets approved by our Compensation Committee. The agreements also grant options to purchase shares of common stock and contain customary non-competition and non-solicitation provisions.

The agreements may be terminated, with or without good cause, by the executive, the Chief Executive Officer or our Board. If the executive’s employment is terminated by us for good cause (as defined in the agreements) or if the executive terminates his own employment for any reason other than for good cause (as defined in the agreements), the executive is entitled to no further compensation or benefits other than those earned through the date of termination. If the executive’s employment is terminated by us for good cause due to death or disability (as defined in the agreement) we will continue payment of the executive’s base salary for six months following termination. If the executive’s employment is terminated by us for any reason other than for good cause, death or disability, or if the executive terminates his own employment for good cause, we will continue payment of the executive’s base salary for nine months following termination, subject to offset by other employment salary received during such period.

16

Potential Payments Upon Termination or Change in Control

Assuming the employment of our named executive officers were to be terminated without cause or for good reason, each as of December 31, 2006, the following individuals would be entitled to payments in the amounts set forth opposite to their name in the below table:

| Cash Severance | |||

| Louis R. Bucalo, M.D. |

$ | 31,583 per month for 24 months | |

| Sunil Bhonsle |

$ | 24,058 per month for 9 months | |

| Robert E. Farrell |

$ | 20,083 per month for 9 months | |

We are not obligated to make any cash payments to these executives if their employment is terminated by us for cause or by the executive not for good reason. No severance or benefits are provided for any of the executive officers in the event of death or disability. A change in control does not affect the amount or timing of these cash severance payments.

Assuming the employment of our named executive officers were to be terminated without cause or for good reason, each as of December 31, 2006, the following individuals would be entitled to accelerated vesting of their outstanding stock options described in the table below:

| Value of Equity Awards: Termination Without Cause or For Good Reason (1) |

Value of Equity Awards: In Connection With a Change in Control (1) | |||

| Louis R. Bucalo, M.D. |

None | Fully Vested. 273,647 options with value of | ||

| Sunil Bhonsle |

None | Fully Vested. 188,334 options with value of | ||

| Robert E. Farrell |

None | Fully Vested. 135,000 options with value of | ||

| (1) | Values are based on the aggregate difference between the respective exercise prices and the closing sale price of our common stock on December 29, 2006, which was $3.32 per share. |

17

DIRECTOR COMPENSATION

Summary of Director Compensation

Non-employee directors are entitled to receive a fee for each meeting attended and all directors are entitled to receive stock options pursuant to our stockholder-approved stock option plans, including an initial grant of 10,000 options upon becoming a director, a biennial grant of 20,000 options thereafter, and an annual grant of 5,000 options for each committee on which they serve. During 2006, each director was granted an annual option to purchase 5,000 shares of our common stock at an exercise price of $2.48, which was equal to the fair market value of our common stock at date of grant, with respect to each committee of the Board on which each director served. In addition to having their out-of-pocket expenses reimbursed, non-employee directors received $2,500 for each Board of Directors meeting attended in 2006. Directors are not precluded from serving us in any other capacity and receiving compensation therefore. Non-employee directors also receive an annual retainer fee of $5,000 in addition to the fee received for each meeting attended.

The following table summarizes compensation that our directors earned during 2006 for services as members of our Board.

| Name |

Fees Earned or Paid in Cash ($) |

Options Awards ($)(1) |

All Other Compensation ($) |

Total ($) | ||||||||

| Victor J. Bauer, Ph.D. |

$ | 15,000 | $ | 35,935 | $ | — | $ | 50,935 | ||||

| Eurelio M. Cavalier |

15,000 | 59,860 | — | 74,860 | ||||||||

| Hubert E. Huckel, M.D. |

15,000 | 64,043 | — | 79,043 | ||||||||

| Dr. Joachim Friedrich Kapp, M.D., Ph.D. |

15,000 | 31,752 | — | 46,752 | ||||||||

| M. David MacFarlane, Ph.D. |

15,000 | 47,702 | — | 62,702 | ||||||||

| Ley S. Smith |

15,000 | 59,860 | — | 74,860 | ||||||||

| Konrad M. Weis, Ph.D. |

12,500 | 56,068 | — | 68,568 | ||||||||

| (1) | Valuation based on the dollar amount of option grants recognized for financial statement reporting purposes pursuant to FAS 123(R) with respect to 2006. The assumptions we used with respect to the valuation of option grants are set forth in our Annual Report on Form 10-K for the year ended December 31, 2006 under “Titan Pharmaceuticals Inc. Consolidated Financial Statements—Notes to Financial Statements—Note 1—Summary of Significant Accounting Policies—Stock-Based Compensation.” The aggregate option awards outstanding for each person in the table set forth above as of December 31, 2006 are as follows: |

| Name |

Vested | Unvested | Exercise Price | ||||

| Victor J. Bauer, Ph.D. |

260,853 | 29,897 | $ | 10.13 | |||

| Eurelio M. Cavalier |

138,853 | 41,147 | 8.02 | ||||

| Hubert E. Huckel, M.D. |

161,853 | 46,147 | 9.87 | ||||

| Dr. Joachim Friedrich Kapp, M.D., Ph.D. |

11,666 | 18,334 | 2.23 | ||||

| M. David MacFarlane, Ph.D. |

57,603 | 32,397 | 2.61 | ||||

| Ley S. Smith |

136,353 | 41,147 | 10.13 | ||||

| Konrad M. Weis, Ph.D. |

120,228 | 42,397 | 9.99 | ||||

18

The grant date fair values of option grants to our directors in 2006 are as follows:

| Name |

Options | Grant Date |

Grant Date Fair Value | ||||

| Victor J. Bauer, Ph.D. |

5,000 | 1/3/2006 | $ | 4,183 | |||

| 20,000 | 8/29/2006 | 31,752 | |||||

| Eurelio M. Cavalier |

5,000 | 1/3/2006 | 4,183 | ||||

| 20,000 | 8/29/2006 | 31,752 | |||||

| 15,000 | 9/5/2006 | 23,925 | |||||

| Hubert E. Huckel, M.D. |

10,000 | 1/3/2006 | 8,366 | ||||

| 20,000 | 8/29/2006 | 31,752 | |||||

| 15,000 | 9/5/2006 | 23,925 | |||||

| Dr. Joachim Friedrich Kapp, M.D., Ph.D. |

20,000 | 8/29/2006 | 31,752 | ||||

| M. David MacFarlane, Ph.D. |

20,000 | 8/29/2006 | 31,752 | ||||

| 10,000 | 9/5/2006 | 15,950 | |||||

| Ley S. Smith |

5,000 | 1/3/2006 | 4,183 | ||||

| 20,000 | 8/29/2006 | 31,752 | |||||

| 15,000 | 9/5/2006 | 23,925 | |||||

| Konrad M. Weis, Ph.D. |

10,000 | 1/3/2006 | 8,366 | ||||

| 20,000 | 8/29/2006 | 31,752 | |||||

| 10,000 | 9/5/2006 | 15,950 | |||||

Assumptions for calculating the grant date fair values are found in our Annual Report on Form 10-K for the year ended December 31, 2006 under “Titan Pharmaceuticals Inc. Consolidated Financial Statements—Notes to Financial Statements—Note 1—Summary of Significant Accounting Policies—Stock-Based Compensation.”

19

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth aggregate information regarding our equity compensation plans in effect as of December 31, 2006:

| Plan category |

Number of securities to (a) |

Weighted-average exercise price of outstanding options (b) |

Number of securities (c) | ||||

| Equity compensation plans approved by security holders |

4,883,804 | $ | 6.80 | 1,279,496 | |||

| Equity compensation plans not approved by security holders (1)(2) |

1,706,406 | $ | 8.03 | 434,688 | |||

| Total |

6,590,210 | $ | 7.12 | 1,714,184 | |||

| (1) | In August 2002, we amended our 2001 Employee Non-Qualified Stock Option Plan. Pursuant to this amendment, a total of 1,750,000 shares of common stock were reserved and authorized for issuance for option grants to employees and consultants who are not officers or directors of Titan. |

| (2) | In November 1999 and in connection with the redemption of warrants, we granted 813,000 non-qualified stock options outside of our stock option plans to our executive officers, at an exercise price of $12.69, vesting equally over 36 months from the date of grant. |

For a discussion of our option plans, see “Executive Compensation—Employee Benefit Plans.”

Certain Relationships

Certain Relationships and Related Transactions.

None.

20

AUDIT RELATED MATTERS

Report of the Audit Committee

The Audit Committee consists of three directors, Ley S. Smith, M. David MacFarlane and Hubert E. Huckel, each of whom meets the independence requirements and standards currently established by the American Stock Exchange and the SEC. The Audit Committee operates under a written charter, a copy of which was included with the Company’s proxy statement for the 2004 Annual Meeting.

The Audit Committee oversees the Company’s financial control and reporting processes on behalf of the Board of Directors. Management is responsible for the financial reporting process including the systems of internal control, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles in the United States. The independent auditors are responsible for planning and performing an audit of the Company’s financial statements in accordance with auditing standards generally accepted in the United States and for auditing management’s assessment of internal control over financial reporting. The independent auditor is responsible for expressing an opinion on those financial statements and on management’s assessment and the effectiveness of internal control over financial reporting based on their audit.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed the audited financial statements in the Annual Report on Form 10-K for the year ended December 31, 2006 with management and the independent auditors, including a discussion of the adoption of accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements and those matters required to be discussed under SAS 61, as amended by SAS 90. In addition, the Audit Committee has received the written disclosures and letter from the independent auditors as required by Independence Standards Board No. 1, and has discussed with the independent auditors the auditors’ independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board No.1.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2006 for filing with the SEC. The Audit Committee and the Board have also recommended, subject to stockholder approval, the selection of Odenberg, Ullakko, Muranishi & Co. LLP as the Company’s independent auditors for the fiscal year ending December 31, 2007.

Ley S. Smith, Chair

Hubert E. Huckel, M.D.

M. David MacFarlane, Ph.D.

| (1) | The material in the above Audit Committee reports is not soliciting material, is not deemed filed with the SEC and is not incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filing. |

21

Principal Accountant Fees and Services

Aggregate fees billed by Odenberg, Ullakko, Muranishi & Co. LLP, an independent registered public accounting firm, during the fiscal years ended December 31, 2006 and 2005 were as follows:

| 2006 | 2005 | |||||

| Audit Fees |

$ | 211,600 | $ | 191,126 | ||

| Audit-Related Fees |

3,000 | 11,315 | ||||

| Tax Fees |

27,590 | 29,628 | ||||

| All Other Fees |

— | — | ||||

| Total |

$ | 242,190 | $ | 232,069 | ||

Audit Fees—This category includes aggregate fees billed by our independent auditors for the audit of Titan’s annual financial statements, audit of management’s assessment and effectiveness of internal controls over financial reporting, review of financial statements included in our quarterly reports on Form 10-Q and services that are normally provided by the auditor in connection with statutory and regulatory filings for those fiscal years.

Audit-Related Fees—This category consists of services by our independent auditors that, including accounting consultations on transaction related matters, are reasonably related to the performance of the audit or review of Titan’s financial statements and are not reported above under Audit Fees.

Tax Fees—This category consists of professional services rendered for tax compliance and preparation of Titan’s corporate tax returns and other tax advice.

All Other Fees—During the years ended December 31, 2006 and 2005, Odenberg, Ullakko, Muranishi & Co. LLP did not incur any fees for other professional services.

The Audit Committee reviewed and approved all audit and non-audit services provided by Odenberg, Ullakko, Muranishi & Co. LLP and concluded that these services were compatible with maintaining its independence. The Audit Committee approved the provision of all non-audit services by Odenberg, Ullakko, Muranishi & Co. LLP.

Pre-Approval Policies and Procedures

In accordance with the SEC’s auditor independence rules, the Audit Committee has established the following policies and procedures by which it approves in advance any audit or permissible non-audit services to be provided to Titan by its independent auditor.

Prior to the engagement of the independent auditors for any fiscal year’s audit, management submits to the Audit Committee for approval lists of recurring audit, audit-related, tax and other services expected to be provided by the independent auditors during that fiscal year. The Audit Committee adopts pre-approval schedules describing the recurring services that it has pre-approved, and is informed on a timely basis, and in any event by the next scheduled meeting, of any such services rendered by the independent auditor and the related fees.

The fees for any services listed in a pre-approval schedule are budgeted, and the Audit Committee requires the independent auditor and management to report actual fees versus the budget periodically throughout the year. The Audit Committee will require additional pre-approval if circumstances arise where it becomes necessary to engage the independent auditor for additional services above the amount of fees originally pre-approved. Any audit or non-audit service not listed in a pre-approval schedule must be separately pre-approved by the Audit Committee on a case-by-case basis.

22

Every request to adopt or amend a pre-approval schedule or to provide services that are not listed in a pre-approval schedule must include a statement by the independent auditors as to whether, in their view, the request is consistent with the SEC’s rules on auditor independence.

The Audit Committee will not grant approval for:

| • | any services prohibited by applicable law or by any rule or regulation of the SEC or other regulatory body applicable to Titan; |

| • | provision by the independent auditors to Titan of strategic consulting services of the type typically provided by management consulting firms; or |

| • | the retention of the independent auditors in connection with a transaction initially recommended by the independent auditors, the tax treatment of which may not be clear under the Internal Revenue Code and related regulations and which it is reasonable to conclude will be subject to audit procedures during an audit of Titan’s financial statements. |

Tax services proposed to be provided by the auditor to any director, officer or employee of Titan who is in an accounting role or financial reporting oversight role must be approved by the Audit Committee on a case-by-case basis where such services are to be paid for by Titan, and the Audit Committee will be informed of any services to be provided to such individuals that are not to be paid for by Titan.

In determining whether to grant pre-approval of any non-audit services in the “all other” category, the Audit Committee will consider all relevant facts and circumstances, including the following four basic guidelines:

| • | whether the service creates a mutual or conflicting interest between the auditor and the Company; |

| • | whether the service places the auditor in the position of auditing his or her own work; |

| • | whether the service results in the auditor acting as management or an employee of the Company; and |

| • | whether the service places the auditor in a position of being an advocate for the Company. |

23

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth, as of July 24, 2007, certain information concerning the beneficial ownership of our common stock by (i) each stockholder known by us to own beneficially five percent or more of our outstanding common stock; (ii) each director; (iii) each executive officer; and (iv) all of our executive officers and directors as a group, and their percentage ownership and voting power.

| Name and Address of Beneficial Owner (1) |

Shares Beneficially Owned (2) |

Percent of Shares Beneficially Owned |

||||

| Louis R. Bucalo, M.D. |

2,371,068 | (3) | 5.3 | % | ||

| Victor J. Bauer, Ph.D. |

279,810 | (4) | * | |||

| Sunil Bhonsle |

1,067,945 | (5) | 2.4 | % | ||

| Eurelio M. Cavalier |

190,416 | (6) | * | |||

| Robert E. Farrell, J.D. |

552,381 | (7) | 1.2 | % | ||

| Hubert E. Huckel, M.D. |

253,626 | (8) | * | |||

| Dr. Joachim Friedrich Kapp, M.D., Ph.D. |

15,000 | (9) | * | |||

| M. David MacFarlane, Ph.D. |

81,250 | (10) | * | |||

| Ley S. Smith |

167,916 | (11) | * | |||

| Konrad M. Weis, Ph.D. |

200,907 | (12) | * | |||

| All executive officers and directors as a group (10 persons) |

5,180,319 | 11.6 | % |

| * | Less than one percent. |

| 1. | Unless otherwise indicated, the address of such individual is c/o Titan Pharmaceuticals, Inc., 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080. |

| 2. | In computing the number of shares beneficially owned by a person and the percentage ownership of a person, shares of common stock of the Company subject to options held by that person that are currently exercisable or exercisable within 60 days are deemed outstanding. Such shares, however, are not deemed outstanding for purposes of computing the percentage ownership of each other person. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock. |

| 3. | Includes 1,821,068 shares issuable upon exercise of outstanding options. |

| 4. | Includes 271,166 shares issuable upon exercise of outstanding options. |

| 5. | Includes 926,551 shares issuable upon exercise of outstanding options. |

| 6. | Includes 160,416 shares issuable upon exercise of outstanding options. |

| 7. | Includes 440,801 shares issuable upon exercise of outstanding options. |

| 8. | Includes (i) 187,583 shares issuable upon exercise of outstanding options, (ii) 200 shares held by Dr. Huckel’s son, and (iii) 3,643 shares held by his wife. |

| 9. | Includes 15,000 shares issuable upon exercise of outstanding options. |

| 10. | Includes 71,250 shares issuable upon exercise of outstanding options. |

| 11. | Includes 157,916 shares issuable upon exercise of outstanding options. |

| 12. | Includes 142,208 shares issuable upon exercise of outstanding options. |

24

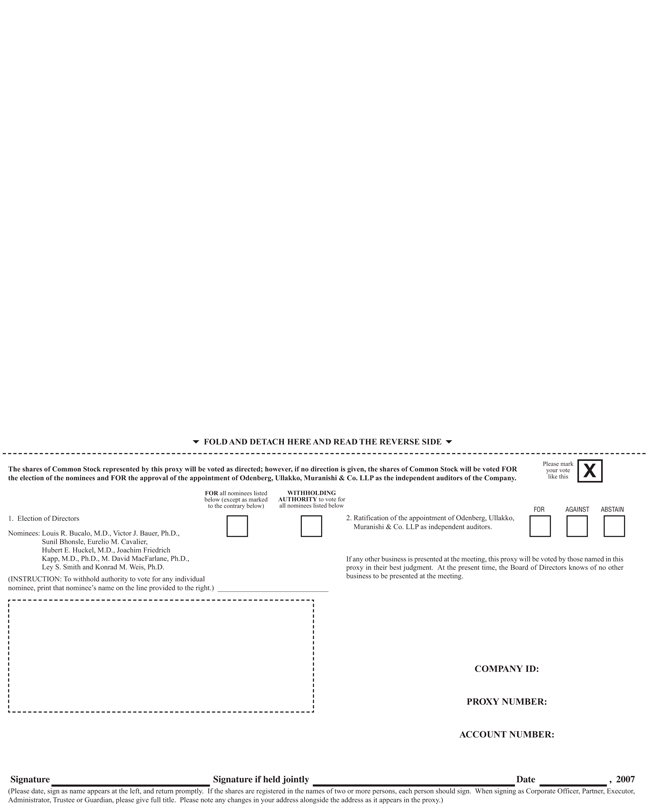

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT AUDITORS