TITAN PHARMACEUTICALS, INC.

400 Oyster Point Boulevard

Suite 505

South San Francisco, California

94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held August 31, 2004

To the Stockholders of

Titan Pharmaceuticals, Inc.

1. |

To elect a board of nine directors; |

2. |

To approve the appointment of Ernst & Young LLP as the independent auditors of the Company for the fiscal year ending December 31, 2004; and |

3. |

To consider and take action upon such other matters as may properly come before the meeting or any adjournment or adjournments thereof. |

Chairman, President and Chief Executive Officer

Dated: July 30, 2004

TITAN PHARMACEUTICALS, INC.

400 Oyster Point Boulevard

Suite 505

South San Francisco, California

94080

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

VOTING SECURITIES

PRINCIPAL STOCKHOLDERS

| Name and Address of Beneficial Owner (1) |

Shares Beneficially Owned (2) |

Percent of Shares Beneficially Owned |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Louis R.

Bucalo, M.D. |

1,970,071 | (3) | 6.1 | % | ||||||

Ernst-Günter Afting, M.D., Ph.D. |

61,750 | (4) | * | |||||||

Richard C.

Allen, Ph.D. |

565,699 | (5) | 1.8 | % | ||||||

Victor J.

Bauer, Ph.D. |

250,644 | (6) | * | |||||||

Sunil

Bhonsle |

853,298 | (7) | 2.7 | % | ||||||

Eurelio M.

Cavalier |

115,832 | (8) | * | |||||||

Robert E.

Farrell, J.D. |

321,082 | (9) | * | |||||||

Hubert

Huckel, M.D. |

147,498 | (10) | * | |||||||

M. David

MacFarlane, Ph.D. |

27,500 | (11) | * | |||||||

Ley S.

Smith |

93,332 | (12) | * | |||||||

Konrad M.

Weis, Ph.D. |

147,156 | (13) | * | |||||||

Kevin Douglas

and The Douglas Family Trust 1101 Fifth Avenue, Suite 360 San Rafael, CA 94901 |

1,874,100 | (14) | 5.8 | % | ||||||

All executive

officers and directors as a group (11) persons |

4,553,862 | 14.2 | % | |||||||

* |

Less than one percent. |

(1) |

Unless otherwise indicated, the address of such individual is c/o Titan Pharmaceuticals, Inc., 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080. |

(2) |

In computing the number of shares beneficially owned by a person and the percentage ownership of a person, shares of common stock of the Company subject to options held by that person that are currently exercisable or exercisable within 60 days are deemed outstanding. Such shares, however, are not deemed outstanding for purposes of computing the percentage ownership of each other person. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock. |

(3) |

Includes 1,538,085 shares issuable upon exercise of outstanding options. |

(4) |

Includes 61,750 shares issuable upon exercise of outstanding options. |

(5) |

Includes 560,934 shares issuable upon exercise of outstanding options. |

(6) |

Includes 237,000 shares issuable upon exercise of outstanding options. |

(7) |

Includes (i) 675,404 shares issuable upon exercise of outstanding options and (ii) 100,000 shares owned by the Bhonsle Family Trust which were sold pursuant to a variable forward sale on June 4, 2001, of which Mr. Bhonsle retains voting power. |

(8) |

Includes 85,832 shares issuable upon exercise of outstanding options. |

(9) |

Includes 273,302 shares issuable upon exercise of outstanding options. |

(10) |

Includes (i) 107,998 shares issuable upon exercise of outstanding options, (ii) 49,900 shares held by a family partnership for which Dr. Huckel serves as general partner, and (iii) 3,000 shares held by his wife. |

(11) |

Includes 17,500 shares issuable upon exercise of outstanding options. |

(12) |

Includes 83,332 shares issuable upon exercise of outstanding options. |

(13) |

Includes 111,582 shares issuable upon exercise of outstanding options. |

(14) |

The given information is derived from a Schedule 13G/A filed by the named holder on February 13, 2004. Of the 1,874,100 shares that are beneficially owned in the aggregate by Kevin Douglas and the Douglas Family Trust, Kevin Douglas has shared voting power over 937,050 shares and shared dispositive power over 1,874,100 shares and the Douglas Family Trust has sole voting power over 937,050 shares and shared dispositive power over 937,050 shares. |

2

EXECUTIVE OFFICERS

| Name |

Age |

Office |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Louis R.

Bucalo, M.D. |

45 | Chairman, President and Chief Executive Officer | ||||||||

Sunil

Bhonsle |

54 | Executive Vice President, Chief Operating Officer and Director | ||||||||

Richard C.

Allen, Ph.D. |

61 | Executive Vice President, Cell Therapy | ||||||||

Robert E.

Farrell, J.D. |

54 | Executive Vice President and Chief Financial Officer | ||||||||

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

| Name |

Age |

Director Since |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Louis R.

Bucalo, M.D. (1) |

45 | March 1993 | ||||||||

Ernst-Günter Afting, M.D., Ph.D. |

61 | May 1996 | ||||||||

Victor J.

Bauer, Ph.D. |

69 | November 1997 | ||||||||

Sunil

Bhonsle |

54 | February 2004 | ||||||||

Eurelio M.

Cavalier (1)(3)(4) |

71 | September 1998 | ||||||||

Hubert E.

Huckel, M.D. (1)(2)(3) |

73 | October 1995 | ||||||||

M. David

MacFarlane, Ph.D. (2)(4) |

63 | May 2002 | ||||||||

Ley S. Smith

(1)(2)(4) |

69 | July 2000 | ||||||||

Konrad M.

Weis, Ph.D. (1)(3) |

75 | March 1993 | ||||||||

(1) |

Member of Executive Committee |

(2) |

Member of Audit Committee |

(3) |

Member of Compensation Committee |

(4) |

Member of Nominating Committee |

4

Director Compensation

5

Board Committees

Meetings of the Board

Communications With the Board of Directors

6

communications will be forwarded to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is clearly of a marketing nature or is unduly hostile, threatening, illegal, or similarly inappropriate, in which case we have the authority to discard the communication or take appropriate legal action regarding the communication.

AUDIT COMMITTEE REPORT (1)

Former

Committee |

Current

Committee |

|||||

Michael K. Hsu,

Chair |

Ley Smith,

Chair |

|||||

Hubert E. Huckel,

M.D. |

Hubert E.

Huckel, M.D. |

|||||

Ley

Smith |

M. David

MacFarlane, Ph.D.* |

|||||

July 9, 2004

* Dr. MacFarlane was appointed to the Audit Committee on May 27, 2004.

(1) |

The material in the above Audit and Compensation Committee reports is not soliciting material, is not deemed filed with the SEC and is not incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filing. |

7

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION (1)

• |

providing levels of compensation competitive with companies in comparable industries which are at a similar stage of development and in the Company’s geographic area; |

• |

identifying appropriate performance goals for the Company; |

• |

integrating the compensation of the executive officers of the Company with the achievement of performance goals; |

• |

rewarding above average corporate performance; and |

• |

recognizing and providing incentive for individual initiative and achievement. |

Eurelio M. Cavalier, Chair

Hubert E. Huckel, M.D.

Konrad M.

Weis, Ph.D.

(1) |

The material in the above Audit and Compensation Committee reports is not soliciting material, is not deemed filed with the SEC and is not incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date of this proxy statement and irrespective of any general incorporation language in such filing. |

8

CODE OF ETHICS

EXECUTIVE COMPENSATION

Summary Compensation Table

| Name and Principal Position |

Year |

Salary Annual Compensation |

Bonus |

Other Compensation |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Louis R. Bucalo,

M.D. President and Chief Executive Officer |

2003 2002 2001 |

$ | 348,000 339,896 $320,252 |

— — $67,005 |

— — — |

|||||||||||||

Sunil Bhonsle

Executive Vice President and Chief Operating Officer |

2003 2002 2001 |

$ | 265,276 259,167 $246,366 |

— — $41,280 |

— — — |

|||||||||||||

Richard C.

Allen, Ph.D. Executive Vice President, Cell Therapy |

2003 2002 2001 |

$ | 232,230 226,821 $217,766 |

— — $36,120 |

— — — |

|||||||||||||

Robert E.

Farrell, J.D. Executive Vice President and Chief Financial Officer |

2003 2002 2001 |

$ | 221,447 216,254 $207,773 |

— — $19,865 |

— $59,766 — |

(1) | ||||||||||||

Frank H. Valone

(2) Executive Vice President Clinical Development and Regulatory Affairs |

2003 2002 |

$ | 237,442 216,827 |

(2) (2) |

— — |

— — |

||||||||||||

(1) |

The amount disclosed for Mr. Farrell represents an accrued vacation payment made in 2002. |

(2) |

Dr. Valone joined the Company in March 2002 and left the Company and ceased to be an officer in October 2003. |

9

Option Grants in Last Fiscal Year

| Individual Grant |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Number of Securities Underlying Options Granted |

% Of Total Options Granted to Employees In Fiscal Year |

Exercise or Base Price ($/Sh) (1) |

Expiration Date |

Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation For Option Terms |

||||||||||||||||||||||

| 5% |

10% |

||||||||||||||||||||||||||

Louis R.

Bucalo |

80,000 | 12.34 | % | $ | 1.50 | 03/01/2013 | $ | 81,983 | $ | 201,624 | |||||||||||||||||

Louis R.

Bucalo |

5,000 | 0.77 | % | $ | 3.29 | 10/31/2013 | $ | 10,345 | $ | 26,217 | |||||||||||||||||

Sunil

Bhonsle |

50,000 | 7.71 | % | $ | 1.50 | 03/01/2013 | $ | 51,239 | $ | 126,015 | |||||||||||||||||

Richard C.

Allen |

35,000 | 5.40 | % | $ | 1.50 | 03/01/2013 | $ | 35,868 | $ | 88,211 | |||||||||||||||||

Robert E.

Farrell |

35,000 | 5.40 | % | $ | 1.50 | 03/01/2013 | $ | 35,868 | $ | 88,211 | |||||||||||||||||

Frank H.

Valone |

40,000 | 6.17 | % | $ | 1.50 | 03/01/2013 | $ | 40,991 | $ | 100,812 | |||||||||||||||||

(1) |

The exercise price may be paid in cash, in shares of common stock valued at the fair market value on the exercise date or through a cashless exercise procedure involving a same-day sale of the purchased shares. |

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End

Option Values

| Number of Securities Underlying Unexercised Options at FY-End |

Value of Unexercised In-The- Money Options at FY-End (1) |

||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Shares Acquired on Exercise |

Value Realized |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||||||||||||||

Louis R.

Bucalo |

— | — | 1,559,923 | 88,251 | $ | 323,457 | $ | 83,100 | |||||||||||||||||||

Sunil

Bhonsle |

— | — | 645,905 | 42,000 | $ | 26,625 | $ | 44,375 | |||||||||||||||||||

Richard C.

Allen |

— | — | 538,267 | 31,417 | $ | 182,302 | $ | 31,063 | |||||||||||||||||||

Robert E.

Farrell |

— | — | 255,177 | 26,875 | $ | 101,273 | $ | 31,063 | |||||||||||||||||||

Frank H.

Valone |

11,666 | $ | 15,166 | 51,621 | 0 | $ | 0 | $ | 0 | ||||||||||||||||||

(1) |

Based on the fair market value of our common stock at year-end, $2.92 per share, less the exercise price payable for such shares. |

10

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING

COMPLIANCE

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER

PARTICIPATION

11

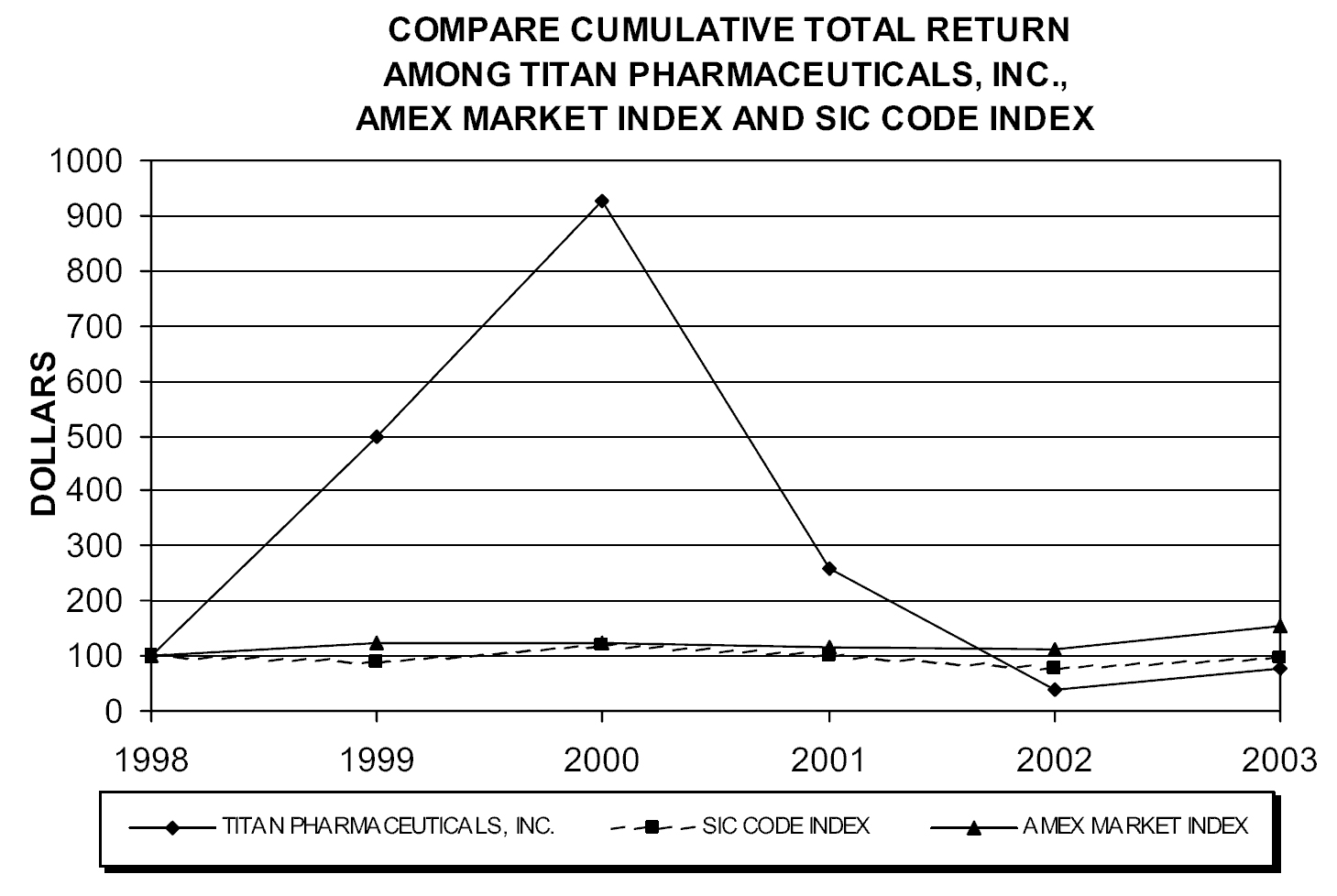

STOCK PRICE PERFORMANCE PRESENTATION

12

PROPOSAL NO. 2

SELECTION OF INDEPENDENT AUDITORS

Fees of Independent Auditor

| 2003 |

2002 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Audit

Fees |

175,500 | 140,381 | ||||||||

Audit-Related

Fees |

9,900 | 95,783 | ||||||||

Tax

Fees |

63,900 | 76,740 | ||||||||

All Other

Fees |

— | — | ||||||||

Total |

249,300 | 312,904 | ||||||||

Pre-Approval Policies and Procedures

13

• |

any services prohibited by applicable law or by any rule or regulation of the SEC or other regulatory body applicable to Titan; |

• |

provision by the independent auditor to Titan of strategic consulting services of the type typically provided by management consulting firms; or |

• |

the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the tax treatment of which may not be clear under the Internal Revenue Code and related regulations and which it is reasonable to conclude will be subject to audit procedures during an audit of Titan’s financial statements. |

• |

whether the service creates a mutual or conflicting interest between the auditor and the Company; |

• |

whether the service places the auditor in the position of auditing his or her own work; |

• |

whether the service results in the auditor acting as management or an employee of the Company; and |

• |

whether the service places the auditor in a position of being an advocate for the Company. |

14

GENERAL

STOCKHOLDER PROPOSALS

Chairman, President and Chief Executive Officer

Dated: July 30, 2004

15

APPENDIX A

AUDIT COMMITTEE CHARTER

OF

TITAN PHARMACEUTICALS, INC.

MISSION STATEMENT

ORGANIZATION AND MEETINGS

Audit Committee Composition

Term; Meetings

A-1

ROLE AND RESPONSIBILITIES

Corporate Governance

1. |

Report on its meetings, proceedings and other activities at each regularly scheduled meeting of the Board, to the extent appropriate. |

2. |

Review and reassess the adequacy of this Charter at least annually. Submit changes to this Charter to the Board for approval. |

3. |

Review and approve all transactions with affiliates, related parties, directors and executive officers. |

4. |

Review the procedures for the receipt and retention of, and the response to, complaints received regarding accounting, internal control or auditing matters. |

5. |

Review the procedures for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

6. |

Review with management and the independent auditors, at least once annually, all correspondence with regulatory authorities and all employees complaints or published reports that raise material issues regarding the financial statements or accounting policies. |

Independent Auditors

1. |

Appoint, compensate, retain and oversee the work of any independent auditor engaged (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of conducting the annual audit of the Company’s books and records, preparing or issuing an audit report or performing other audit review or attest services for the Company. |

2. |

Obtain and review, at least once annually, a report by the independent auditors describing (i) their internal quality control procedures, (ii) any material issues raised by the most recent internal quality control review or peer review or by any inquiry or investigation by any governmental or professional authority within the preceding five years, in each case with respect to one or more independent audits carried out by them, (iii) all material steps taken to deal with any such issues and (iv) all relationships between them and the Company. |

3. |

Review annually the independence of the independent auditors by (i) receiving from the independent auditors a formal written statement delineating all relationships between the independent auditors and the Company in accordance with Independence Standards Board Standard No. 1, (ii) discuss with the independent auditors all disclosed relationships between the independent accounts and the Company and all other disclosed relationships that may impact the objectivity and independence of the independent auditors and (iii) discussing with management its evaluation of the independence of the independent auditors. |

A-2

4. |

Obtain from the independent auditors assurance that the lead audit partner and the audit partner responsible for reviewing the audit have been and will be rotated at least once every five years and each other audit partner has been and will be rotated at least once every seven years, in each case, in accordance with Section l0A of the Securities Exchange Act of 1934, as amended (the “Act”) and the rules promulgated thereunder. |

5. |

Review and pre-approve, all audit, review or attest services (including comfort letters in connection with securities underwritings and tax services) and all non-audit services to be provided by the independent auditors as permitted by Section 10A of the Exchange Act and the rules promulgated thereunder, and, in connection therewith, the terms of engagement. The Audit Committee may designate one member to approve such non-audit services, but that member must inform the Audit Committee of the approval at the next meeting of the Audit Committee. All such approvals and procedures must be disclosed in periodic reports filed with the SEC. |

6. |

Review and approve all compensation to the independent auditors for all audit and non-audit services. |

7. |

Review regularly with the independent auditors any audit problems or difficulties and management’s response, including restrictions on the scope of activities of the independent auditors or access by the independent auditors to requested information, and significant disagreements between the independent auditors and management. |

8. |

Present conclusions with respect to the independent auditors to the Board. |

Audits and Accounting

Before the commencement of the annual audit, the Audit Committee will meet with financial management and the independent auditor to review and approve the plan, scope, staffing, fees and timing of the annual audit. The Audit Committee shall:

1. |

After completion of the audit of the financial statements, review with management and the independent auditors the results of the audit, the audit report, the management letter relating to the audit report, all significant questions (resolved or unresolved) that arose and all significant difficulties that were encountered during the audit, the disposition of all audit adjustments identified by the independent auditors, all significant financial reporting issues encountered and judgments made during the course of the audit (including the effect of different assumptions and estimates on the financial statements) and the cooperation afforded or limitations (including restrictions on scope or access), if any, imposed by management on the conduct of the audit. |

2. |

Review, prior to filing, all annual reports on Form 10-K and all quarterly reports on Form 10-Q, to be filed with the SEC. Discuss with management and the independent auditors, where practicable, prior to filing, the financial statements (including the notes thereto) and the disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. |

3. |

Review with management and the independent auditors, at least annually, (i) all significant accounting estimates, (ii) all significant off balance sheet financing arrangements and their effect on the financial statements, (iii) all significant valuation allowances and liability, restructuring and other reserves, (iv) the effect of regulatory and accounting initiatives, and (v) the adequacy of financial reporting. |

4. |

Review with management and the independent auditors all reports delivered by the independent auditors in accordance with Section 10A(k) of the Securities Exchange Act of 1934 with respect to critical accounting policies and practices used, alternative treatments of financial information available under GAAP and other written communications (including letters under SAS No. 50) between the independent auditors and management, together with their ramifications and the preferred treatment by the independent auditors. |

5. |

Discuss with the independent auditor and management the independent auditor’s judgment about the quality, not just the acceptability, of the Company’s accounting principles, as applied in the Company’s financial reporting in accordance with SAS No. 61. |

6. |

Review and discuss with management and the independent auditors the Company’s earnings press releases (paying particular attention to the use of any “pro forma” or “adjusted” non-GAAP information), as well as financial information and earnings guidance provided to analysts and rating agencies. This review may be generally of disclosure and reporting policies. The Committee need not discuss in advance each earnings press release or each instance in which the Company may provide earnings guidance. |

A-3

7. |

Prepare the report required by the SEC to be included in the Company’s annual proxy statement and any other reports of the Audit Committee required by applicable securities laws or stock exchange listing requirements or rules. |

Monitoring of Internal Controls Systems

1. |

Meet separately in executive session, at least annually, with the Company’s principal accounting officer to discuss: |

a) |

the scope of internal accounting and auditing procedures then in effect; |

b) |

the Company’s means for monitoring compliance by Company personnel with Company policies and procedures and applicable law; and |

c) |

the extent to which recommendations made by the principal accounting officer or independent auditor have been implemented. |

2. |

Review, based upon the recommendation of the independent auditors and financial management, the scope and plan of the work to be done by the internal audit group and the responsibilities, budget and staffing needs of the internal audit group. |

3. |

Review on an annual basis the performance of the internal audit group. |

4. |

In consultation with the independent auditors and the internal audit group, the accounting and financial controls, review the adequacy of the Company’s internal control structure and procedures designed to insure compliance with laws and regulations, and any special audit steps adopted in light of material deficiencies and controls. |

5. |

Review (i) the internal control report prepared by management, including management’s assessment of the effectiveness of the design and operation of the Company’s internal control structure and procedures for financial reporting, as well as the Company’s disclosure controls and procedures, with respect to each annual and quarterly report that the Company is required to file under the Securities Exchange Act of 1934 and (ii) the independent auditors’ attestation, and report, on the assessment made by management. |

Other

1. |

Engage and determine funding for independent counsel and other advisors as it determines necessary to carry out its duties. |

2. |

Conduct any and all investigations it deems necessary or appropriate. |

Adopted: May 27, 2004

A-4

APPENDIX B

Nominating Committee Charter

1. |

Make recommendations to the Board regarding the size and composition of the Board, establish procedures for the nomination process and screen and recommend candidates for election to the Board. |

2. |

To review with the Board from time to time the appropriate skills and characteristics required of Board members. |

3. |

To establish and administer a periodic assessment procedure relating to the performance of the Board as a whole and its individual members. |

B-1

|

q FOLD AND DETACH HERE AND READ THE REVERSE SIDE q |

||||||||||||||||||||

|

|

|

|||||||||||||||||||

|

The shares of Common Stock represented by this proxy will be voted as directed; however, if no direction is given, the shares of Common Stock will be voted FOR the election of the nominees, FOR the approval of the appointment of Ernst & Young LLP as the independent auditors of the Company. |

|

Please

mark |

X |

|

||||||||||||||||

|

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

FOR all nominees listed |

WITHHOLDING |

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

1. Election of Directors |

|

|

|

|

|

|

2. Approval of the

appointment |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Nominees: |

Louis R. Bucalo, M.D., Ernst-Günter Afting, M.D., Ph.D., Victor J. Bauer, Ph.D., Sunil Bhonsle, Eurelio M. Cavalier, Hubert E. Huckel, M.D., M. David MacFarlane, Ph.D., Ley S. Smith and Konrad M. Weis, Ph.D. |

|

|

|

|

|

|

|

||||||||||||

|

|

If any other business is presented at the meeting, this proxy will be voted by those named in this proxy in their best judgment. At the present time, the Board of Directors knows of no other business to be presented at the meeting. |

|||||||||||||||||||

|

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

(INSTRUCTION: To withhold authority to vote for any individual nominee, print that nominee’s name on the line provided below.) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

COMPANY ID: |

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

PROXY NUMBER: |

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

ACCOUNT NUMBER: |

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

Signature___________________________ Signature if held jointly ________________________ Date________________ , 2004 |

||||||||||||||||||||

|

(Please date, sign as name appears at the left, and return promptly. If the shares are registered in the names of two or more persons, each person should sign. When signing as Corporate Officer, Partner, Executor, Administrator, Trustee or Guardian, please give full title. Please note any changes in your address alongside the address as it appears in the proxy.) |

||||||||||||||||||||

|

q FOLD AND DETACH HERE AND READ THE REVERSE SIDE q |

|

|

|

PROXY |

|

|

|

TITAN PHARMACEUTICALS, INC. |

|

|

|

ANNUAL MEETING OF STOCKHOLDERS |

|

|

|

This Proxy is Solicited on Behalf of the Board of Directors |

|

|

|

The undersigned hereby appoints Dr. Louis R. Bucalo or Sunil Bhonsle as proxy to represent the undersigned at the Annual Meeting of Stockholders to be held at 400 Oyster Point Boulevard, Suite 505, South San Francisco, California 94080 on August 31, 2004 at 9:00 a.m., local time, and at any adjournments thereof, and to vote the shares of Common Stock the undersigned would be entitled to vote if personally present, as indicated below. |

|

|

|

CONTINUED AND TO BE SIGNED ON REVERSE SIDE |